Healing the Healthcare System: How eClaim Dhamani is Rewriting UAE’s Insurance Playbook

In an increasingly digital world, the healthcare industry continues to innovate, seeking solutions that enhance efficiency, accuracy, and transparency. One such initiative that is revolutionizing the health insurance processing landscape in the UAE is eClaim Dhamani. This article delves into what eClaim Dhamani is, its significance, and how it’s transforming the health insurance ecosystem in the UAE.

What is eClaim Dhamani?

eClaim Dhamani is a centralized electronic platform designed to streamline the health insurance claims process in the United Arab Emirates. The initiative, launched by the Dubai Health Authority (DHA), aims to enhance the efficiency and transparency of health insurance claims while improving the overall patient experience. By leveraging advanced technology, eClaim Dhamani facilitates the seamless exchange of health information between healthcare providers, insurers, and regulatory authorities.

Objectives of eClaim Dhamani

1. Streamlining Claims Processing

eClaim Dhamani aims to simplify and standardize the health insurance claims process, reducing delays and administrative burdens.

2. Ensuring Data Accuracy and Transparency

The platform ensures that all health data is accurate and easily accessible, fostering transparency and trust among stakeholders.

3. Enhancing Regulatory Compliance

eClaim Dhamani helps ensure that health insurance claims processing adheres to the regulatory standards set by the DHA.

4. Improving Patient Experience

By streamlining processes and reducing wait times, eClaim Dhamani aims to enhance the overall patient experience in the healthcare system.

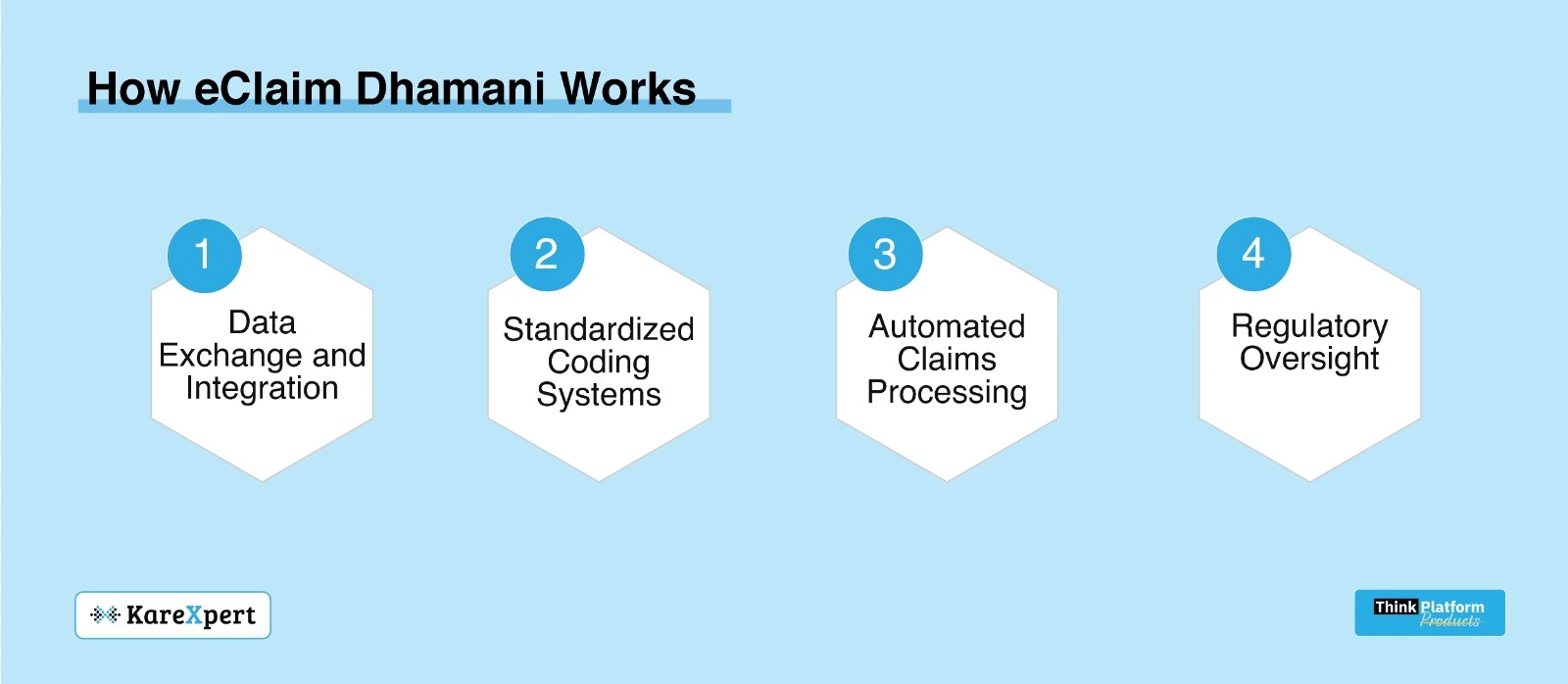

How eClaim Dhamani Works

eClaim Dhamani operates by integrating various stakeholders in the healthcare ecosystem, including healthcare providers, insurance companies, and regulatory bodies:

1. Data Exchange and Integration

The platform facilitates real-time data exchange between healthcare providers and insurers, ensuring that patient information is updated and accurate.

2. Standardized Coding Systems

eClaim Dhamani uses standardized coding systems such as ICD-10 and ICD-11 to ensure consistency and accuracy in medical records and claims processing.

3. Automated Claims Processing

The platform automates many aspects of the claims process, from submission to approval, significantly reducing administrative burdens and processing times.

4. Regulatory Oversight

The DHA has regulatory oversight of the eClaim Dhamani platform, ensuring that all processes adhere to established standards and regulations.

Key Benefits of eClaim Dhamani

1. Enhanced Efficiency

By automating claims processing and streamlining data exchange, eClaim Dhamani significantly enhances operational efficiency for both healthcare providers and insurers. This leads to faster claims approval and reduced administrative workloads.

2. Improved Data Accuracy

The use of standardized coding systems and real-time data integration ensures that health information is accurate and consistent across the healthcare ecosystem. This reduces the risk of errors and discrepancies in medical records and claims.

3. Increased Transparency

eClaim Dhamani fosters transparency by providing all stakeholders with access to accurate and up-to-date information. This promotes trust and accountability in the health insurance process.

4. Regulatory Compliance

The platform ensures that health insurance claims processing adheres to the regulatory standards set by the DHA, reducing the risk of non-compliance and associated penalties.

5. Better Patient Experience

By streamlining processes and reducing wait times, eClaim Dhamani enhances the overall patient experience. Patients can expect faster claims approval and smoother interactions with healthcare providers and insurers.

Impact on Healthcare Providers

For healthcare providers, eClaim Dhamani offers several advantages:

1. Streamlined Operations

The platform automates many aspects of the claims process, reducing the administrative burden on healthcare staff. This allows healthcare providers to focus more on patient care and less on paperwork.

2. Accurate Medical Records

With standardized coding systems and real-time data integration, healthcare providers can maintain accurate and up-to-date medical records. This ensures that patients receive the right treatments and that claims are processed accurately.

3. Improved Cash Flow

Faster claims processing means that healthcare providers receive payments more quickly, improving their cash flow and financial stability.

Impact on Insurance Companies

For insurers, eClaim Dhamani provides several key benefits:

1. Efficient Claims Processing

The platform automates claims processing, reducing the time and effort required to review and approve claims. This leads to faster turnaround times and improved operational efficiency.

2. Accurate and Consistent Data

eClaim Dhamani ensures that all health data is accurate and consistent, reducing the risk of errors and discrepancies in claims. This enhances the reliability of the claims process.

3. Regulatory Compliance

The platform helps insurers ensure that their claims processing practices adhere to the regulatory standards set by the DHA, reducing the risk of non-compliance and associated penalties.

Impact on Patients

For patients, eClaim Dhamani offers several key benefits:

1. Faster Claims Approval

The platform streamlines the claims process, reducing the time it takes for patients to receive approval for their claims. This ensures that patients receive timely care without delays.

2. Enhanced Transparency

eClaim Dhamani provides patients with access to accurate and up-to-date information about their health insurance claims. This promotes transparency and trust in the healthcare system.

3. Improved Patient Experience

By reducing wait times and streamlining processes, eClaim Dhamani enhances the overall patient experience. Patients can expect smoother interactions with healthcare providers and insurers.

Challenges and Considerations

While eClaim Dhamani offers numerous benefits, there are challenges and considerations that need to be addressed:

1. Data Privacy and Security

Ensuring the privacy and security of health data is a critical concern. Robust security measures and compliance with regulations such as GDPR and HIPAA are essential to protect sensitive patient information.

2. Technical Integration

Integrating eClaim Dhamani with existing healthcare systems and infrastructure can be complex. Healthcare organizations need to invest in the necessary technology and resources to ensure seamless integration.

3. Stakeholder Collaboration

Successful implementation of eClaim Dhamani requires collaboration among various stakeholders, including healthcare providers, insurers, and regulatory bodies. Building trust and fostering cooperation are key to achieving the objectives of the platform.

Future Directions

As technology continues to evolve, eClaim Dhamani is expected to incorporate advanced features such as artificial intelligence (AI) and machine learning (ML). These technologies can enhance predictive analytics, improve disease detection, and enable more personalized care. Additionally, the platform may expand to include other healthcare services and applications, further driving digital health transformation.

eClaim Dhamani represents a significant advancement in the health insurance processing landscape in the UAE. By streamlining claims processing, ensuring data accuracy and transparency, enhancing regulatory compliance, and improving the patient experience, eClaim Dhamani is revolutionizing healthcare delivery. While challenges remain, the potential benefits make it a worthwhile investment for healthcare organizations seeking to stay ahead in the rapidly evolving healthcare landscape.

Are you ready to embrace the future of health insurance processing with eClaim Dhamani? Contact KareXpert today to learn more about how our advanced solutions can help you harness the power of eClaim Dhamani for improved health outcomes.